Originally published in Swedbank’s private banking client magazine “Fookus”.

Looking to buy an electric car? The bold-lined sporty Chinese SUV Aiways U6 would be a trendy choice. Want to go for a test drive? Sure! Just schedule a time at Euronics and the car will be prepped and ready for you. Enjoyed the ride? Great! Get all the necessary steps of the purchase process done on the manufacturer’s website and the car will be delivered to your doorstep.

At first glance, the above story seems to be a bit off, to put it mildly. But this is actually already the reality in Germany, as this is exactly how this specific Chinese car can be purchased over there. And there’s certainly no shortage of interest since one Euronics store sees around 40 test drives a week.

According to the French consulting company Inovev, the percentage of Chinese electric vehicles in European new electric car sales will grow from the current 6% to a couple dozen percent by 2030. That’s about a million cars per year.

Changes in the sales model and Chinese car brands are some of the biggest new trends in the European car market. This time, Raido Toonekurg, the chairman of the board of automotive software company Modera, will share his expert opinion on what the European car market has got coming in the next few years.

Here come the electric vehicles

There’s no turning back when it comes to the rule of electric vehicles. This trend is led by a combination of factors. Firstly, a change in people’s thought patterns where an environmentally friendly car is now a conscious choice. Secondly, the rules and regulations set forth by legislators, and thirdly the decisions of car manufacturers.

The European Union’s decision to only allow the sale of cars and vans that create zero CO2 emissions from 2035 is both a clear sign and an assurance to manufacturers as to where to direct their focus from hereon.

The permission to sell new cars with an internal combustion engine after 2030 does however leave the door open in case not enough lithium needed for batteries can be mined by then, but this does not affect the trend.

According to Raido, big manufacturers have taken a clear direction towards electric vehicles, and they’re ambitions are great.

Volkswagen Group, which includes Volkswagen, Audi, Škoda, Seat, Porche and many others and sold a quarter of all the new cars in Europe, has promised that by 2030, 70% of all the cars they sell are electric vehicles. Stellantis, which includes Peugeot, Fiat, Citroën, Opel, Jeep, DS, Lancia and Alfa Romeo and owns about a fifth of the market, is aiming to reach a full 100% by the same time – an ambition shared by the Renault Group with a 10% market share.

Currently, manufacturers are actively trying to turn their entire selection electric. Raido is certain that this will be achieved within the next two to three years.

Chinese electric vehicles – a rising trend

Last year, the most sold models of electric vehicles in Europe were Tesla Model Y and Model 3 with a combined market share of 8%. There really are no outstanding leaders on the market at this point.

On a global scale, Chinese manufacturers have taken a solid lead. Chinese BYD Auto sold over 1.8 million electric vehicles last year and is a clear global leader with a 20% market share. You should memorize the names of their three most popular models Song, Qin and Han, as BYD is looking to bring these models to the European market this year. According to Raido, Chinese electric vehicle manufacturers have finally gotten over the hump, making the increase of their models in the European market one of the biggest trends.

The selling points are strong. High quality when it comes to both durability and driving range, as well as appearance and the design of the salon. Of course we can’t forget the price as Chinese cars tend to be cheaper especially in the more low-cost price range. At the same time, a Chinese car falling in the average car price range in Europe, usually comes with several premium-class features.

Although, thus far, the most sold electric vehicles in Europe belonged to Chinese companies, but were initially under European brands such as MG and Polestar as well ask Lynk & Co, now more and more fully Chinese brands like Aiways, NIO, XPeng, BYD and others are finding their footing on the market.

The consulting firm Inovev believes that it’s quite a conservative expectation that in seven years every fifth electric vehicle sold in Europe will be by a Chinese brand.

Car from the web and straight from the manufacturer

The rise of Chinese electric vehicles will also change the traditional sales model. Carlos Tavares, the head of Stellantis, has said that if European manufacturers want to stay in competition, they need to find ways to cut costs. One way is to reduce the share of the price given to resellers.

An upcoming trend is buying cars straight from the manufacturers. In Sweden, Mercedes has already started with this model and many other European countries are following their lead. For example, the same decision has been made by BMW and Stellantis Group. Resellers will enjoy the pleasure of organizing test drives along with some compensation, but the buying and selling will happen between the manufacturer and the consumer.

Some Chinese brands who don’t have an effective cooperation agreement with European resellers are trying out new ways of selling. This is where the story described at the beginning of this article falls under – customers looking to buy an Aiways car can take a test drive at an Euronics store in Germany.

Although 40 test drives a week per store is not a small number, in the end, what counts is still how many of those drives turn into actual purchases. It would probably be naive to expect a strong reseller-type sales approach from Euronics. Since it’s yet to be determined how significant of a role reseller’s marketing approach plays in finalizing a sale, companies like Toyota, Kia and Renault are still continuing with their existing sales model for now.

From a buyer’s perspective, it really doesn’t matter whether they’re checking out their choices on the manufacturer’s or reseller’s website and who they end up finalizing the deal with. As a trend however, it’s worth mentioning that the entire car buying process from picking out the model and putting together the ideal fit, to finalizing the leasing and buying contracts, will become increasingly more digital.

Decreasing importance of owning a car

The time when a kid would work and save money to make their dream of owning a car a reality, is now in the past. Owning a car, or really anything material is not as important to young people anymore and their focus has shifted on being more environmentally friendly. At the same time, the actual need for a personal car is also declining.

A short term rental is easy and becoming even more simple. Numerous car rental companies are making it very convenient to rent a car. Some companies can even deliver the rental car at your doorstep by managing it remotely. These fast developing solutions are also reducing the need for a second or third family car.

There’s an increasing selection of 4‒6 month rentals. For example, Modera, whose system includes various car sellers, is currently developing an easy solution to rent a car for a few months.

Delivery service keeps evolving. We’ll see an increasing number of cars that are bringing things right to our doorstep.

Raido Toonekurg believes that these trends will not drastically reduce the need for new cars however, at least not on a global scale. Big countries such as China and India are just getting started with owning their cars and driving.

When will we see self-driving cars?

There’s been a lot of talk about self-driving cars, but at one of the most influential technology exhibitions CES, held at the beginning of the year in the USA, big car manufacturers shared a clear message that no great breakthroughs are expected in that area in the next few years. At this time, everyone’s focused on developing electric vehicles and changing their sales models. Autonomous vehicles will evolve where they’re used in a limited area and on specific trajectories.

On a higher level, where artificial intelligence is driving a car in general traffic without the need for human interaction, there are still many unanswered questions even outside the technology. For example, a programmer would have to install the right choice in the artificial brain in a situation where, in case of an inevitable accident, the car would either hit an 8 year old kid or an 80 year old person. Who’s going to make this decision? Who’s going to be responsible for the end result in that case – would it be the manufacturer? Manufacturers are not eagerly rushing into situations full of potential lawsuits and court cases.

Exceptional infotainment

Let’s end on a lighter note however. Thus far, trying to navigate the touch screen of a car has proven to be much less enjoyable than tapping away on your smartphone. Luckily, there’s reason to believe this is about to change. Finally, car manufacturers have started to focus more on making the info and entertainment systems in the cars easier and more intuitive.

What’s going to happen with the prices?

Currently, the price difference between electric vehicles and cars with internal combustion engines is the smallest in the premium-class car range. As a trend, we can see that prices are becoming more uniform in all classes. On one hand, cheaper electric vehicles are entering the market, while on the other hand, the price for petrol cars is on the rise.

One of the reasons for such increase in pricing are the taxes set forth by governments on cars producing CO2 emissions. The leasing percentage and insurance payment will also become more dependent on the size of the carbon footprint of the car and the loan applicant.

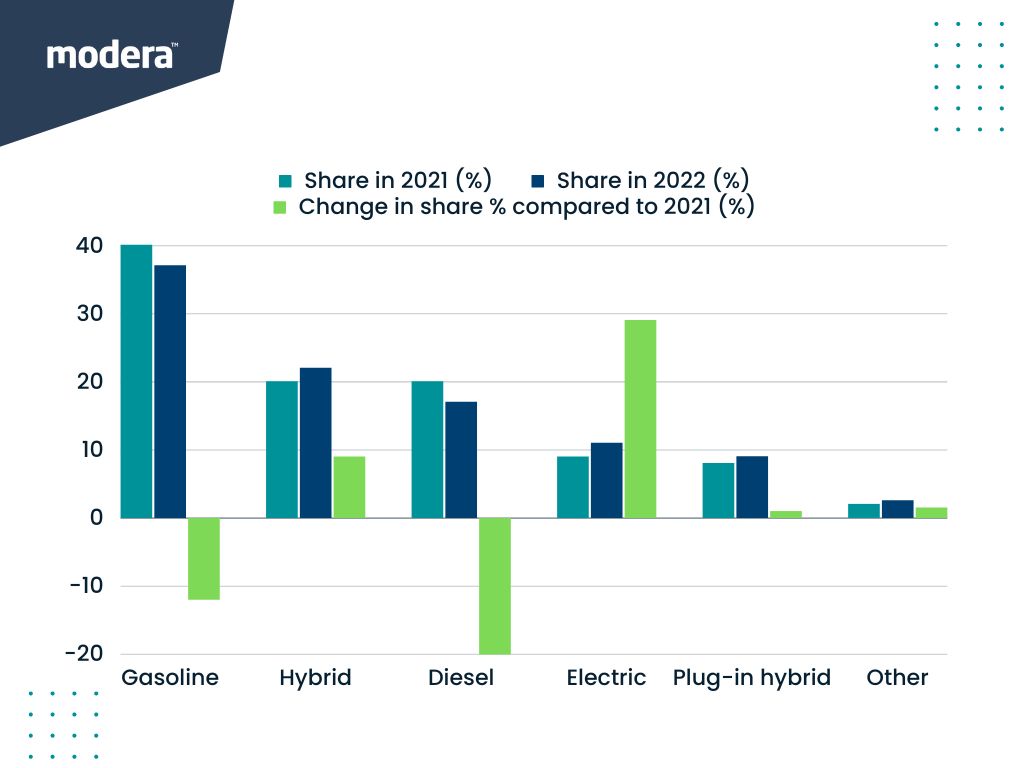

The sale of new electric vehicles in the European Union

The light blue bar shows the share of cars running on different types of fuel in new vehicle sales in 2021 and the dark blue bar in 2022. The orange bar shows the percentage increase or decrease in the share compared to 2021. The share of electric cars increased the most and the share of diesel cars decreased.

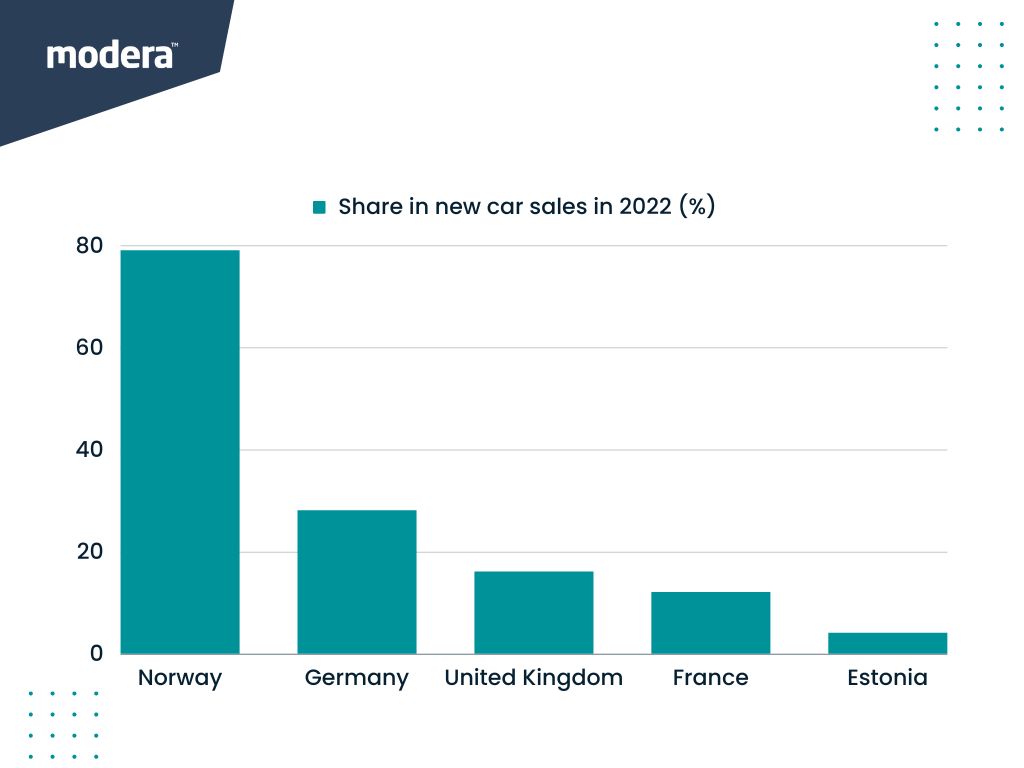

Electric car sales by country

While electric cars made up 3,4% (731 cars) of all new car sales in Estonia last year, in Norway, it was a whopping 79,3% (138 207 cars). The biggest electric car markets in Europe are Germany (471 394 new electric vehicles sold last year), the UK (267 203) and France (203 122).